I. Background and current situation

In 2022, global battery metal prices hit a record high, mainly affected by multiple factors such as the supply chain disruption caused by the COVID-19 pandemic, the conflict between Russia and Ukraine, and the subsequent international sanctions. At the same time, the demand for advanced lithium batteries for electric vehicles, off-highway vehicles, material handling and other industrial equipment continues to accelerate, further driving the rise in battery metal prices.

II. Battery metal price fluctuations

Price fluctuations of key metals such as lithium, nickel and cobalt

Lithium: In February 2022, the price of battery-grade lithium carbonate reached RMB 500,000 per ton, nine times the price in 2020.

Nickel: Nickel prices fluctuated due to the war in Ukraine and the COVID-19 lockdown in China, but by April 2022 they had basically stabilized at US$30,000-35,000 per ton.

Cobalt: Although not specifically mentioned, prices also fluctuate due to the overall market.

Super cycle forecast

Battery metal prices are expected to fall sharply in 2023-2024 due to the influx of investors into raw material production.

By 2026, prices will rise sharply again as new demand enters the market.

3. Battery chemical composition selectio

Due to the different price increases of lithium batteries with different chemical compositions, people tend to choose cheaper and more reliable LFP (lithium iron phosphate) batteries instead of NMC (lithium nickel manganese cobalt oxide) and NCA batteries.

LFP batteries have higher thermal stability and simpler battery pack design, and their cost advantages are obvious.

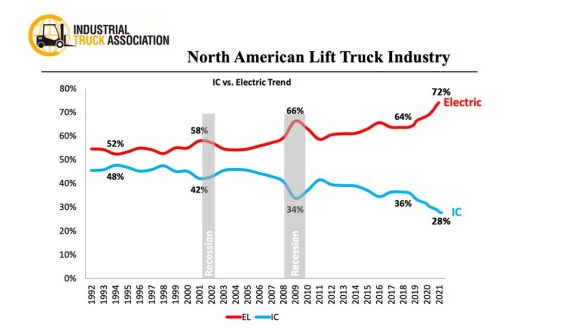

4. Electrification trend in material handling industry

Despite the fluctuations in battery metal prices, the long-term trend of electrification of industrial trucks and other equipment will continue until 2030 and beyond.

The demand for higher efficiency and the promotion of new regulations (such as California's ban on propane and diesel forklifts) have accelerated the electrification of material handling equipment.

5. Global battery metal mining and production

China dominates the battery metal production industry, but long-term developments in North America (such as the Inflation Control Act) may weaken China's advantage.

The United States and Canada are working together to develop a North American battery metal supply chain to compete with China.

More sustainable mining practices and innovative technologies (such as solid-state batteries) are emerging, which are expected to alleviate the shortage of lithium materials.

VI. Future Outlook

It is expected that by 2030, the global demand for electric vehicles will grow by 30% annually, and the annual valuation of the battery value chain will reach US$410 billion.

The electrification trend of the material handling industry will not be hindered by battery prices, and will continue to promote industry development and technological progress.

VII. Conclusion

The fluctuation of battery metal prices has had a certain impact on the electrification trend of the material handling industry, but the overall trend has not changed. With the continuous advancement of technology and the continuous promotion of policies, the material handling industry will continue to develop in the direction of electrification and efficiency. At the same time, the competition in global battery metal mining and production will also become more intense, requiring countries and companies to strengthen cooperation and innovation to jointly meet market challenges.